Something I always say is that vacations are my favorite time to teach kids about money. When you include lessons about how much these big ticket trips cost, how much small things cost throughout the day, and even the analogies and lessons that come along the way, kids will have a much better understanding of how money can be spent. This experience will aid them in pondering their own Awesome Stuff™, and deciding what they think is worth spending money on.

Kids love to feel involved in the process and in big decision making. Allow them to feel mature and let them know their opinions and choices matter as well.

Leading up to your vacation, it’s a great practice to include your entire family in the planning process. Being transparent about how much the flights cost, how much the hotel costs and all the small things in between will open their eyes to the luxury of a vacation. Odds are, they will likely be surprised by how much a beach vacation or a trip to Disneyland ACTUALLY costs.

When you’re finally in vacation mode and enjoying all that your adventure has to offer, consider another teaching opportunity: Take the money that you’ve set aside for spending on them while you’re there and give them the freedom to spend it themselves. Allow them to make the decisions, good or bad, on what they choose to spend their money on.

Help them to understand how much money they have available and what certain items such as food or souvenirs might cost. It’s always fun to see how they might choose to spend their money. When you run out of funds, that’s all they get.

This will likely factor into their gratitude for the financial freedom you have provided the family to experience things like this, and if you’re lucky, they will begin to prioritize this financial freedom in their own finances.

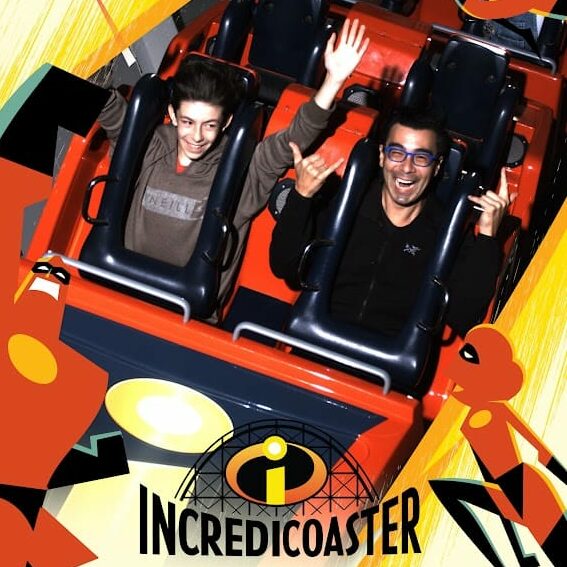

Another great analogy is the lesson that comes with roller coasters themselves. Their favorite rides go up and down, and you never know when the next drop is coming. Compare this to the stock market. Teach your kids that stocks will constantly fluctuate and drops will be guaranteed, but the important part is anticipating them. When the big dives come up and you don’t expect them, you immediately panic. As long as you are prepared for the drops ahead of you, you never need to worry about the outcome.

Having a long-term financial plan is the same idea. If you’re investing in the drops long term (10, 20, even 30 years) it will always pan out in the end.

One of my favorite Indiana Jones quotes is: “Real rewards come to those who choose wisely”. This is a great lesson that comes back to spending money and saving up for The Awesome Stuff™. When you choose wisely and spend money on the things that you truly value, you will be deeply rewarded with happiness and long-term fulfillment.

With all of these examples to assist your children in understanding how much a vacation costs, how they can make their spending money last, and even how roller coasters are comparable to the stock market, they will grow to understand finances in a brand new way. Their appreciation for the opportunities you’ve created for them by working and investing money will grow with these lessons and experiences. Hopefully one day they will teach their own children the same lessons and spend their wealth on The Awesome Stuff™.