After the excitement of the holidays continues to die down, you may feel it’s time to get your life back on track in more ways than one. Whether you’re still trying to find places to store all your kids’ new toys or have already gotten your house put back in order, there’s still likely the issue of what to do with any money your kids may have received.

For the youngsters around us, gifts are really exciting. Yet, the gift of money may feel overwhelming to many children and young adults. My graphic novel for children, The Golden Quest, dives into the simple habits and mindset shifts that largely impact money and investing. The book teaches kids (and adults) how to live a richer life and create the freedom for what’s really important to them, The Awesome Stuff™.

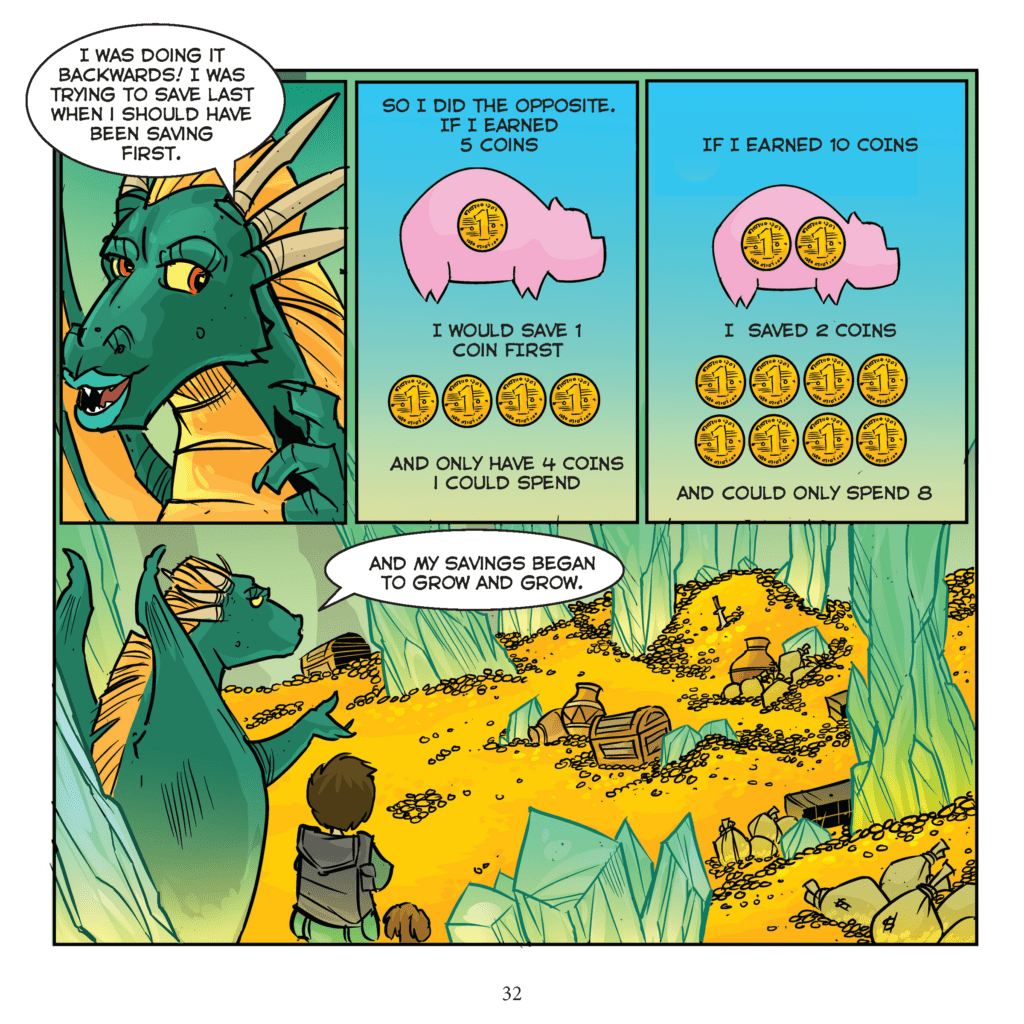

When it comes to money that has been gifted to your children, my first rule is to always save first – no matter what. Though it may be tempting for them to make an exciting purchase with their new-found wealth, the habit of saving will become much more rewarding. Set a percentage (I recommend 20%) of any money that comes in into savings and let your child choose what they would like to do with the remaining funds, whether that be spending or saving.

By creating a rigid rule of how much of their money will always be put away, kids get into the habit of recognizing how money is meant to be saved. The more your children see their saved money grow, the more they may choose to invest their leftover money and watch it build even more over time. And what I love the most about this habit, is that they can spend what’s left over completely guilt free; they have already taken care of their saving and financial future.

My biggest lessons on how to multiply your money starts with the mindset of saving. For most people, the overall goal with money is to have more. There is nothing wrong with this mindset, but go even further to think about why your children want more and how that money can actually earn money for them and create greater freedom. The backbone of any financial lesson is to always save first because wealth cannot come without saving first.

The concept of saving can be hard for some kids to understand. It can be a struggle to combat the desire to spend what we have. Prioritize saving as the first step to tricking your mind into not realizing the money was there to begin with, thus adapting to only spending what is in front of you. By implementing these small habits at an early age, kids will carry the lesson forever and cultivate a lifetime of wealth.

Saving and investing money should be a lesson that all parents are transparent with their children about. Part of this is explaining how costs are broken down. If parents and kids have conversations about how much dinner costs, how much a toy costs, or how much money was given to them, it can be much easier for them to conceptualize. This conversation is important to have when young adults receive money themselves, as they begin to understand how much of their money can go towards something they enjoy, or, what we like to call, The Awesome Stuff™.

Money conversations can be scary for both adults and adolescents, but it doesn’t have to be. These recommendations are just the beginning of how you can start educating kids about smart financial decisions. The earlier we expose our children to the details of finances, the more confident they will be in their future wealth.